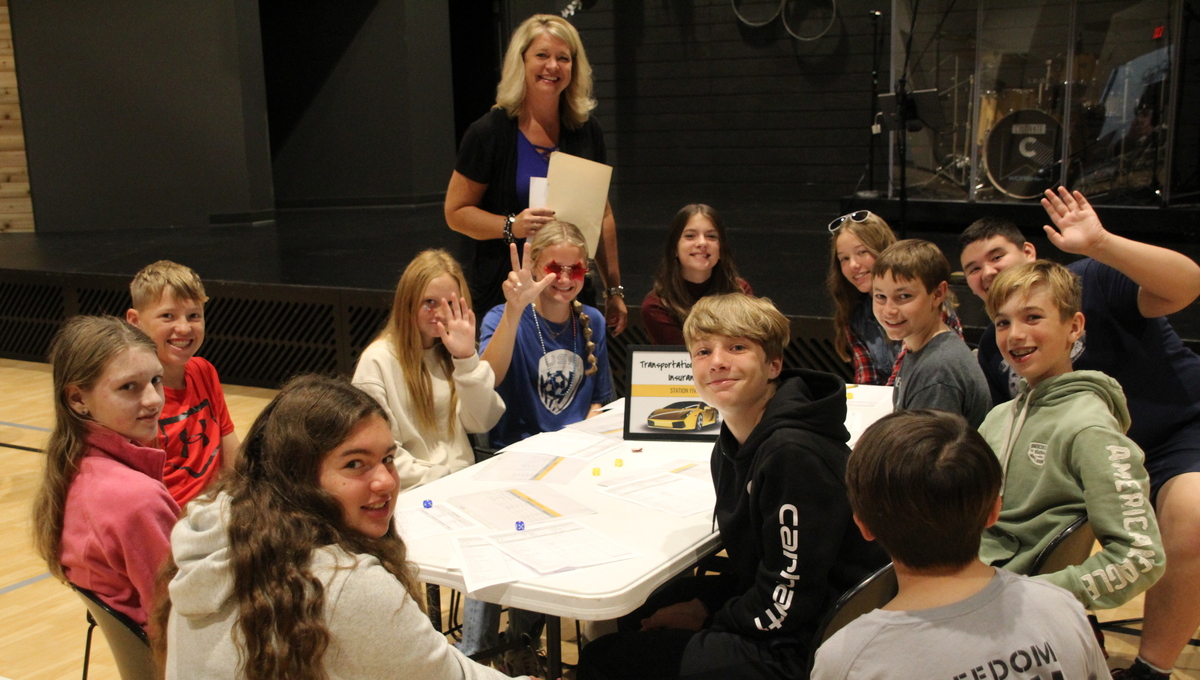

Financial success starts at a young age which is why Hamilton Community Schools continues the annual '8th Grade Reality Store'. Work Based Learning coordinator Ashley Meyer, along with several business professionals from our community set up the financial simulation at Cultivate Community Church to give students a glimpse into adulthood.

Students went through ten stations beginning with rolling dice for their family situation (married or single, amount of children, etc.) before selecting a career, home, vehicle, and everything in between. Immediately, the students learned about taxes and insurance on their big dream houses and vehicles.

"I am very thankful for this experience because I can look back and say oh I learned this in 8th grade," said HMS student Daisy Solis. "It's important to learn how to keep track of my money."

Fellow 8th grader Chase Morrison chose to be a kinesiologist, which brought home a nice salary but he learned a lot from the rest of his situation.

"I had a child and was married but my wife made no money and was unemployed, I pay $4,000 in taxes," he explained.

Some students had to attend college for their careers and quickly learned about student loans, interest on those loans, and debt.

"It's just sad, things cost way too much," Solis chuckled, "You look at the prices of things you need and want and keep thinking 'Am I going to go into debt?'"

At the end of the ten station process evaluating their financial situations, students were hit with a 'reality check', which set some of them back depending on how much money they were saving in their emergency funds.

"My reality check I had something happen where I had to pay $10,000," Morrison added, "The reality check definitely changed things quickly."

Some students didn't have medical or dental insurance through their employers and learned how expensive those medical bills can be after breaking their legs, needing a surgery, etc.

"You fell and broke your leg, do you have health insurance?" Asked one community professional at the reality check station. "You do have health insurance? Okay, that's $274."

The experience was enlightening for all students.

"As an adult, I'll have to make some better decisions," Solis added. "My parents give me some money here and there for doing chores or other work and I haven't really thought about what things cost, but now I will definitely look and think twice."